What Types Of Services Does The Federal Government Provide With Tax Dollars For The Poor

It's springtime, which means the commencement of the budgeting process for Congress and a mad dash for many Americans to file their income taxes. That makes it a good time to look at the federal government'southward spending habits in a broader context than just this year's battles.

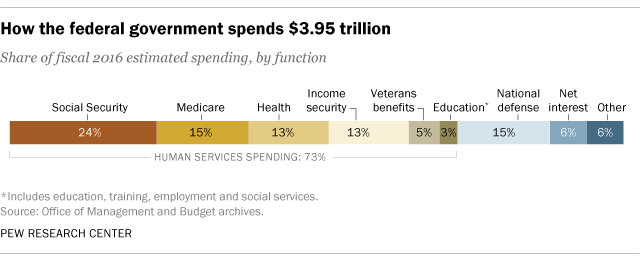

When thinking well-nigh federal spending, it's worth remembering that, every bit former Treasury official Peter Fisher once said, the federal authorities is basically "a gigantic insurance company," admitting one with "a sideline business concern in national defence and homeland security." In financial year 2016, which ended this past Sept. xxx, the federal government spent just under $4 trillion, and about $2.vii trillion – more two-thirds of the total – went for various kinds of social insurance (Social Security, Medicaid and Medicare, unemployment compensation, veterans benefits and the like). Another $604 billion, or 15.three% of full spending, went for national defense; net interest payments on regime debt was virtually $240 billion, or vi.1%. Education assistance and related social services were almost $114 billion, or less than three% of all federal spending. Everything else – crop subsidies, infinite travel, highway repairs, national parks, foreign assist and much, much more than – accounted for the remaining vi%.

It can exist helpful to look at spending as a share of the overall U.S. economic system, which provides a consistent frame of reference over long periods. In financial 2016, total federal outlays were 21.5% of gross domestic product, or Gross domestic product. For most of the past several decades, federal spending has hovered inside a few per centum points above or below 20%. The biggest recent exception came in the wake of the 2008 mortgage crash: In fiscal 2009, a surge in federal relief spending combined with a shrinking economy to push button federal outlays to 24.4% of GDP, the highest level since World War II, when federal spending peaked at almost 43% of GDP. (We relied on archived historical data from former President Barack Obama'south final upkeep for our spending data; President Donald Trump's initial budget proposal doesn't include any historical data.)

Measured as a share of Gdp, the biggest long-term growth in federal spending has come up in human being services, a broad category that includes various kinds of social insurance, other health programs, education aid and veterans benefits. From less than i% of Gdp during World War Ii (when many Depression-era aid programs were either concluded or shifted to the war effort), federal spending on human services now amounts to 15.5% of Gross domestic product. It really was higher – 16.1% – in fiscal 2010, largely due to greater spending on unemployment compensation, nutrient assistance and other forms of aid during the Great Recession. Now, the primary growth drivers of homo-services spending are Medicaid, Medicare and Social Security.

Measured as a share of Gdp, the biggest long-term growth in federal spending has come up in human being services, a broad category that includes various kinds of social insurance, other health programs, education aid and veterans benefits. From less than i% of Gdp during World War Ii (when many Depression-era aid programs were either concluded or shifted to the war effort), federal spending on human services now amounts to 15.5% of Gross domestic product. It really was higher – 16.1% – in fiscal 2010, largely due to greater spending on unemployment compensation, nutrient assistance and other forms of aid during the Great Recession. Now, the primary growth drivers of homo-services spending are Medicaid, Medicare and Social Security.

While spending on human services has grown to stand for a greater share of Gross domestic product over time, the defence force share has become smaller: Information technology was 3.iii% in fiscal 2016, versus iv.vii% as recently as fiscal 2010. In general, and perhaps non surprisingly, defense spending consumes more of Gdp during wartime (well over a third at the height of Earth State of war II) and less during peacetime. The major exception was the Reagan-era military buildup (which actually accelerated a buildup that began late in the Carter administration): From a post-Vietnam low of four.5% of Gdp in financial 1979, defense spending somewhen peaked at 6% of GDP in fiscal 1986.

Besides man services and national defence, the adjacent-biggest category of federal spending is interest on public debt. Excluding interest paid to authorities trust funds (such as the Social Security and war machine-retirement trust funds) and various other modest authorities loan programs, the $240 billion in internet interest paid on federal debt in financial 2016 represented 1.3% of GDP. Even though total public debt has continued to grow (it stood at virtually $19.96 trillion in February, hitting the statutory debt limit), the dollar amount of actual interest paid fluctuates with the general interest charge per unit environment. Rates are quite low now, but they were much higher in the 1980s and 1990s; in those decades, net interest payments often approached or exceeded 3% of GDP.

Related posts:

A closer look at who does (and doesn't) pay U.S. income tax

Congress has long struggled to pass spending bills on time

What Types Of Services Does The Federal Government Provide With Tax Dollars For The Poor,

Source: https://www.pewresearch.org/fact-tank/2017/04/04/what-does-the-federal-government-spend-your-tax-dollars-on-social-insurance-programs-mostly/

Posted by: hughesmorst1955.blogspot.com

0 Response to "What Types Of Services Does The Federal Government Provide With Tax Dollars For The Poor"

Post a Comment